Enhance Your Heritage With Specialist Trust Foundation Solutions

In the realm of tradition planning, the relevance of developing a strong structure can not be overemphasized. Expert trust fund structure remedies offer a robust structure that can safeguard your properties and guarantee your dreams are executed specifically as planned. From decreasing tax obligation responsibilities to picking a trustee who can effectively handle your affairs, there are vital considerations that demand attention. The intricacies associated with trust fund frameworks require a tactical method that aligns with your long-term objectives and worths (trust foundations). As we explore the nuances of depend on structure services, we discover the key aspects that can fortify your heritage and give an enduring influence for generations ahead.

Advantages of Trust Structure Solutions

Trust structure solutions use a robust framework for safeguarding possessions and making certain long-lasting economic security for people and companies alike. Among the primary benefits of trust fund foundation services is possession protection. By establishing a trust fund, individuals can shield their possessions from possible risks such as claims, creditors, or unexpected monetary commitments. This protection guarantees that the possessions held within the depend on remain protected and can be passed on to future generations according to the person's dreams.

Furthermore, count on foundation services offer a tactical method to estate planning. Through trusts, people can outline how their properties need to be taken care of and dispersed upon their death. This not only aids to stay clear of problems amongst beneficiaries but additionally makes certain that the person's tradition is preserved and managed properly. Depends on likewise offer personal privacy benefits, as assets held within a trust are not subject to probate, which is a public and frequently lengthy lawful procedure.

Sorts Of Trusts for Tradition Planning

When thinking about legacy planning, a crucial element entails exploring numerous types of legal tools designed to protect and disperse assets successfully. One usual sort of depend on made use of in heritage preparation is a revocable living count on. This depend on permits individuals to preserve control over their possessions throughout their life time while guaranteeing a smooth shift of these properties to beneficiaries upon their passing, preventing the probate procedure and giving privacy to the family.

One more kind is an unalterable trust fund, which can not be altered or revoked once established. This count on uses possible tax obligation advantages and shields properties from creditors. Charitable trusts are also popular for individuals wanting to support a cause while maintaining a stream of income for themselves or their recipients. Unique demands trust funds are crucial for people with handicaps to guarantee they get needed treatment and support without jeopardizing government advantages.

Understanding the various sorts of counts on readily available for heritage planning is essential in developing a thorough method that lines up with specific goals and priorities.

Selecting the Right Trustee

In the realm of heritage planning, an essential element that demands cautious consideration is the choice of an appropriate person to fulfill the crucial role of trustee. Picking the best trustee is a choice that can considerably influence the successful execution of a trust fund and the satisfaction of the grantor's dreams. When selecting a trustee, it is necessary that site to prioritize high qualities such as reliability, financial acumen, stability, and a dedication to acting in the very best rate of interests of the recipients.

Ideally, the picked trustee ought to possess a strong understanding of financial issues, be capable of making audio investment choices, and have the capability to navigate complicated legal and tax obligation requirements. By meticulously thinking about these factors and choosing a trustee who lines up with the values and goals of content the trust, you can assist ensure the long-lasting success and preservation of your tradition.

Tax Obligation Ramifications and Advantages

Taking into consideration the fiscal landscape surrounding trust fund structures and estate planning, it is vital to look into the complex world of tax obligation implications and benefits - trust foundations. When establishing a depend on, recognizing the tax obligation implications is important for enhancing the advantages and decreasing potential liabilities. Counts on provide different tax obligation benefits relying on their framework and objective, such as lowering inheritance tax, revenue tax obligations, and present tax obligations

One substantial advantage of particular trust fund frameworks is the capacity to move possessions to recipients with minimized tax repercussions. As an example, irrevocable trusts can remove assets from the grantor's estate, possibly decreasing inheritance tax obligation. Additionally, some trust funds permit earnings to be distributed to beneficiaries, that may be in reduced tax brackets, causing overall tax obligation cost savings for the family.

Nonetheless, it is necessary to note that tax regulations are complicated and conditional, stressing the requirement of talking to tax obligation professionals and estate preparation professionals to ensure compliance and make the most of the tax obligation benefits of trust foundations. Properly browsing the tax obligation ramifications of trusts can cause significant cost savings and a more effective transfer of wide range to future generations.

Steps to Developing a Trust

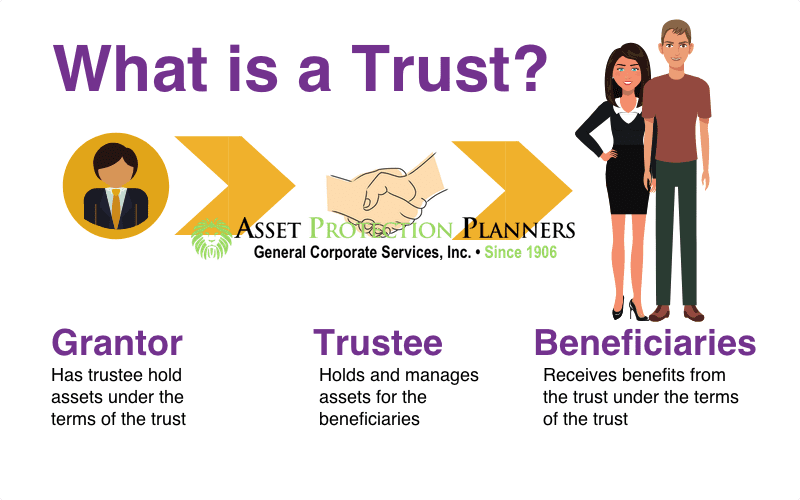

To develop a trust effectively, thorough interest to information and adherence to lawful protocols are imperative. The initial step in establishing a count on is to plainly specify the purpose of the depend on and the properties that will be included. This includes recognizing the recipients who will benefit from the trust fund and appointing a trustworthy trustee to handle the properties. Next off, it is crucial to choose the type of depend on that ideal aligns with your goals, whether it be a revocable count on, irreversible depend on, or living trust fund.

Conclusion

In verdict, establishing a trust fund foundation can give many benefits for tradition preparation, including possession security, control over circulation, and tax benefits. By selecting the ideal sort of trust fund try these out and trustee, individuals can secure their assets and ensure their dreams are accomplished according to their wishes. Understanding the tax effects and taking the necessary steps to develop a trust can assist reinforce your legacy for future generations.